Dear Neighbours,

I just received my annual council tax bill. I thought it could be helpful if I explain how it’s calculated and where your money goes.

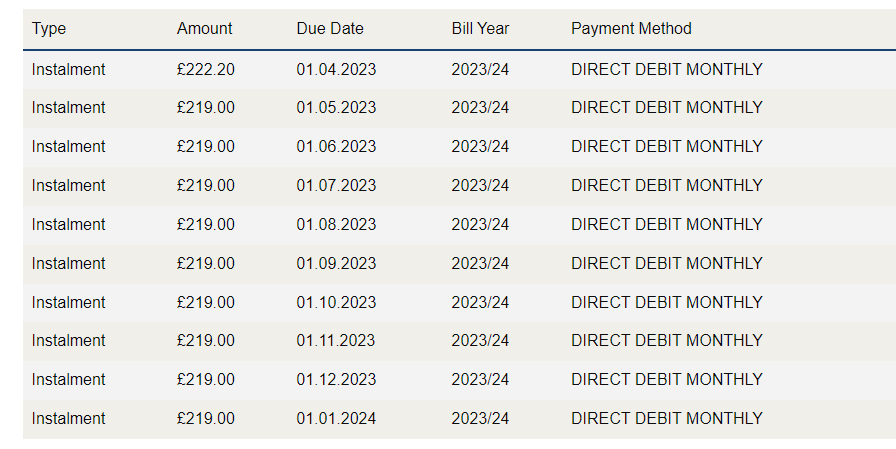

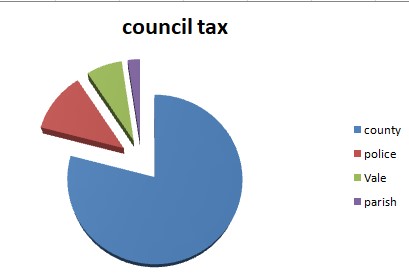

Although your monthly direct debit (well, it’s a 10 out of 12 months DD, to be exact) says Vale of White Horse District Council, only a small portion of that payment actually goes to Vale. Vale is the collector and administers the accounts, receiving payment and sending on the appropriate amounts to the County, Police, and parish.

I once asked Vale Finance officers if we could change the name of the payee on Direct Debits, because when I see Vale of White Horse in my statement, it seems like all the money goes to Vale. I thought if we could change that name, it could be clearer. But I was told that no, the name on the bank account has to be the council who serves as the administrator and pays the correct portions to other parties.

I once asked Vale Finance officers if we could change the name of the payee on Direct Debits, because when I see Vale of White Horse in my statement, it seems like all the money goes to Vale. I thought if we could change that name, it could be clearer. But I was told that no, the name on the bank account has to be the council who serves as the administrator and pays the correct portions to other parties.

So here we go.

Your council tax is based on the value of your house in 1991. That’s right. Nothing has been revalued since then. If your house is newer, the Valuation office assesses its 1991-equivalent value to use as a council tax calculation.

My house in North Hinksey Parish is a Band D property,

County Council Tax

My band D house pays £173.40 per month (over 10 months) to the County Council. That’s an increase of £8.24 per month for the coming year.

Thames Valley Police Tax

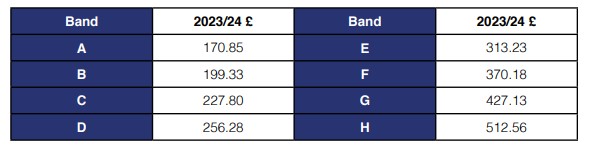

It’s harder to find this information out. They publish this table on the website:

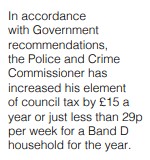

In the text narrative on that webpage, they explain they raised the tax this year by £15.

So let’s try my maths skills. This year is £256.28. It is a £15 increase for the coming year, which means my tax last year must’ve been £241.28. Right? Divided by 10 months, means I used to pay £24.13 per month.

My Band D house pays £25.63 per month (over 10 months) to Thames Valley Police. That’s an increase of £1.50 per month for the coming year.

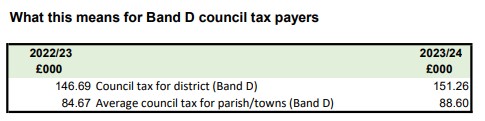

Vale of White Horse Tax

Last year I paid £146.69 per month to Vale.

My Band D house pays £15.12 per month (over 10 months) to Vale of White Horse. That’s an increase of £.45 (45 pence) per month for the coming year.

Town or Parish Tax

The green table above shows the average parish precept. But I looked up the actual precepts for a Band D property, which are set by the parish council or parish meeting.

North Hinksey: £51.20, or £5.12 per month.

Wytham: £39.44 or £3.94 per month

Sunningwell: £55.33 or £5.53 per month

South Hinksey: £105.06 or £10.51 per month

In Summary

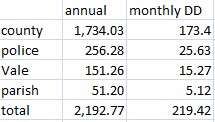

Add the monthly amounts for each of the taxing agencies: County, Police, District, parish, and you have the total.

For my annual amounts, it is: £1734.03 + £256.28 + £151.26 + £51.20 = 2192.77

For my monthly payment, then, it is: £173.40 + £25.63 + £15.12 + £5.12 = £214.27

That adds up to £2193.20, whereas I expected to be charged £2192.77. It’s down to rounding errors on my part.

And that’s how it works.

Best wishes, and kind regards,

Debby